Fruta Casino extends exciting bonus and promotional offers to new and existing players on top of its fantastic games. The casino offers an impressive selection of bonus offers and free spin packages to give new as well as existing players an incentive to play.

Fruta Casino has clearly taken steps to ensure maximum safety and security for players and this casino. The all casino will impress you with their vibrant visuals, superior animations, and realistic sound effects that further improve the quality of your gaming experience.

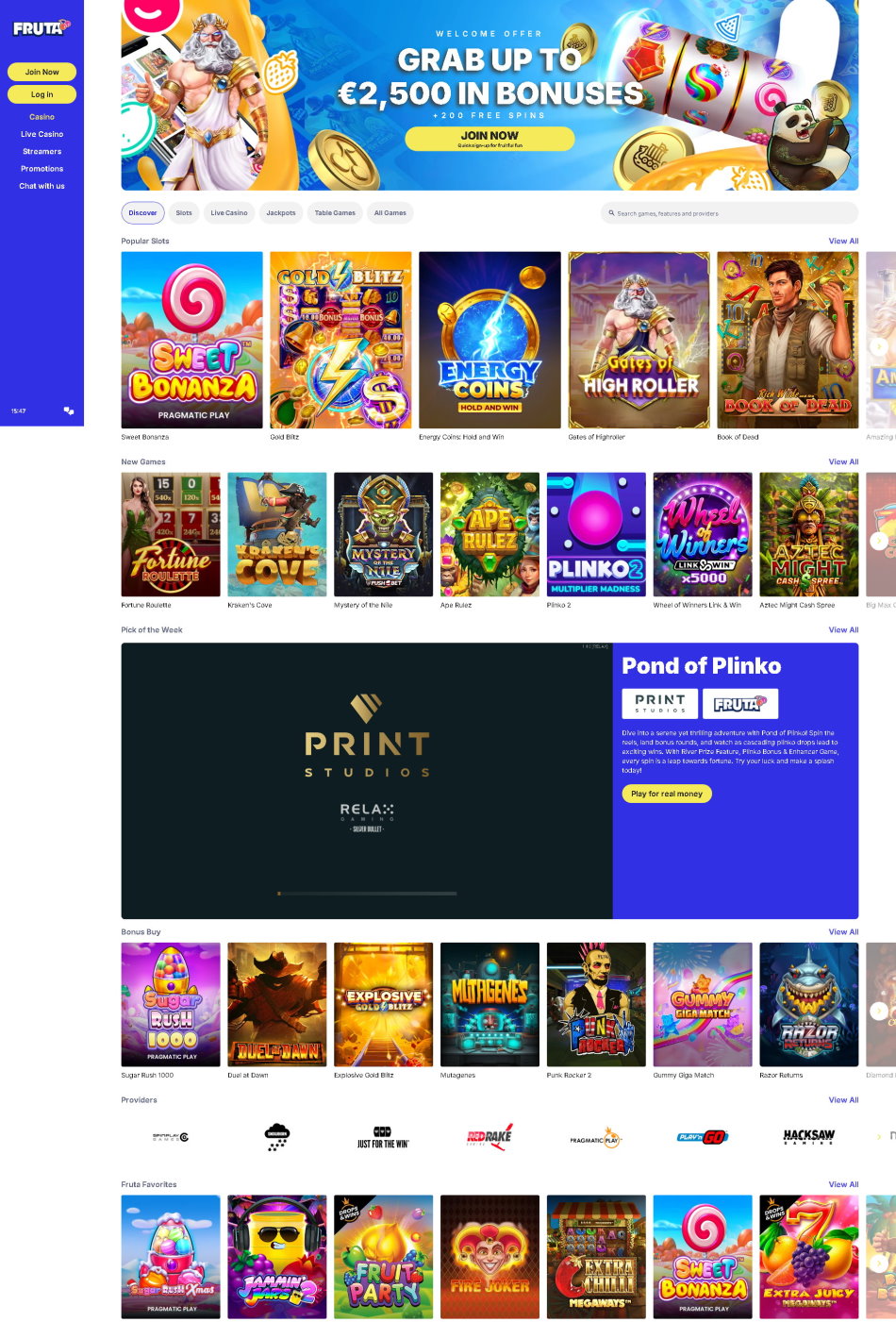

Fruta Casino offers a classic casino experience with dozens of games from various providers to keep you happy. The casino has a pretty active promotions calendar with reload bonuses and free spins on offer while new players can sign up for a generous welcome bonus.

Fruta Casino uses software from some of the most well-known online and mobile casino software providers. These include Betsoft, Booming, NoLimit City, RedRake, Fazi, Realistic, Habanero, Wazdan, IG Tech, Mr. Slotty, Gamevy, Lucky, Playson, Tom Horn and iSoftbet. Each game comes to live with superb animations, crisp visuals, immersive sound effects, and user-friendly interface to the benefit of both seasoned and inexperienced players.

Fruta Casino allows members to access all the games via any computer, and by using advanced smartphones. No need to download anything. The website is also compatible with devices that use iOS, Android, and Windows Phone OS. The games can tweak their software according to device specifications, enabling you to play on any device, browser, or operating system.

What is interesting about Fruta Casino is their collection of games features some excellent software providers. Popular slots at the casino include Spooky Family, Cloud Tales, Boomanji, The King, Alkemor's Tower, Queen and the Dragons and Crazy Monkeys. The selection of table games is equally impressive and includes different versions of blackjack, roulette and video poker, as well as more exotic games such as scratch cards or bingo.

Fruta Casino is operated by a company called Digi Media N.V. under the licensing of the Curacao government. All games are fair at this casino: the casino uses a RNG that has been tested and certified by a reputed third party testing agency.

Fruta Casino uses the latest cutting edge 128-bit Secure Socket Layer (SSL) digital encryption technology to safeguard your personal information, account balance and any and all transactions you make. All user information is kept on a remote server that cannot be accessed by any 3rd party organisation.

Fruta Casino is fully SSL-encrypted to safeguard both your bank transactions as well as your personal details. Any personal or confidential data that players provide the casino with is stored in secure servers, which are guarded continuously using sophisticated firewalls.

Deposits and withdrawals at Fruta Casino are 100% secure. The casino supports a few popular instant deposit options and reasonably quick withdrawal methods. These methods include: Visa debit and credit cards, MasterCard credit card and Neosurf. The casino accepts payments in US Dollars ($) and Euros

Fruta Casino recruits highly qualified and well-trained customer support agents and offers round-the-clock customer support. The customer support team is available through live chat and also email 24/7 should any problems arise for the players. You'll also be able to browse around and read through the comprehensive FAQ page which should answer most of the common questions that you may have for the casino.